Drew Angerer/Getty Images

- Americans' savings rose by $1.6 trillion during the pandemic thanks to stimulus and weak spending.

- Some experts fear households will quickly spend their savings and fuel runaway inflation.

- Studies suggest most will hold onto the cash even after the US reopens, Fed researchers said.

- See more stories on Insider's business page.

Gradual reopening and widespread vaccination have economists wondering how Americans will spend in a post-pandemic economy. Researchers at the Federal Reserve Bank of New York see little cause for concern.

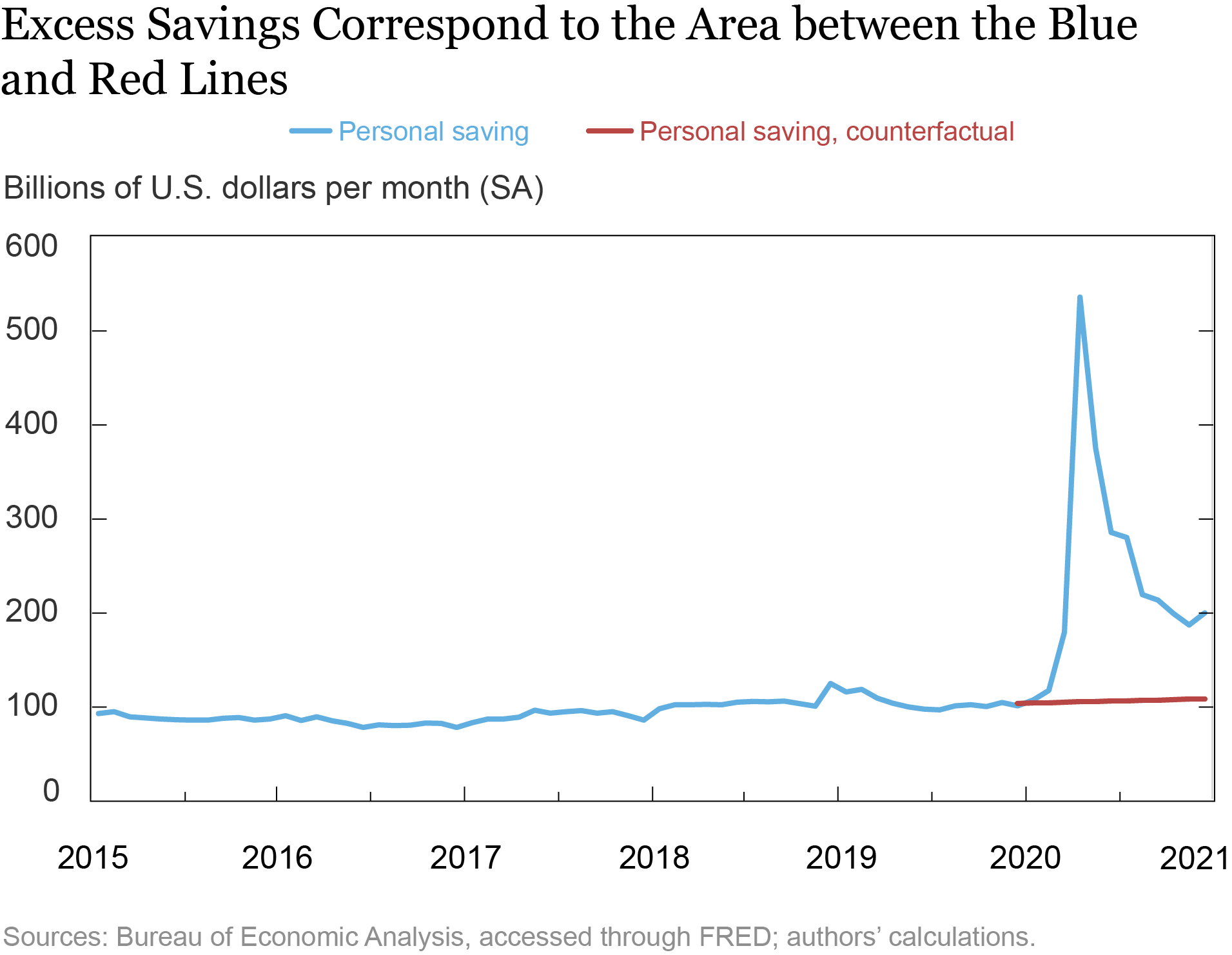

Americans enjoyed a savings surge during the pandemic as government stimulus hit households and lockdown measures cut down on spending. Estimates suggest people held on to roughly $1.6 trillion in savings since last March, when the health crisis first slammed the economy.

The sum highlights the scale of the government's support throughout the coronavirus recession. Yet some experts fear that, if too much of these savings are spent too quickly, the recovery will be disrupted as rampant inflation takes hold.

Such a demand bounce is unlikely, professors and economists at the New York Fed said in a Monday blog post. For one, Americans who kept their jobs still haven't spent nearly as much as they would in a pre-pandemic economy.

"Increased purchases of furniture, electronics, and other goods have compensated only in part for this reduced spending on services," the economists said. "As a result, overall consumption has fallen for many households, even if their income is more or less intact."

The roughly $5 trillion in stimulus passed by President Donald Trump and President Joe Biden over the last year also contributed to the savings boom. Relief doled out in direct payments and expanded unemployment benefits was used to pay down debts and cover living costs, but some was tucked away as savings.

It's also possible that some households increased their saving habits as a precautionary measure due to uncertainty around how the economy would fare, the researchers said.

Federal Reserve Bank of New York

The very nature of excess savings suggests they won't be unwound too quickly. Stimulus recipients spent roughly one-third of the government support, according to Fed estimates. The rest was mostly saved, likely by households that already enjoy a financial buffer. It's possible that circumstances change and force Americans to tap their savings sooner than expected, but the economy's steady recovery should lead habitual savers to keep holding on to their funds, the team said.

Even when the economy fully reopens and Americans have more ways to deploy their cash, the researchers don't expect a sudden rise in spending. Many are sure to dine out more often or take a vacation that wouldn't have been taken otherwise, but there's a limit to how much a household can boost its discretionary spending, the team said.

"It is certainly possible that some of these savings will pay for extra travel and entertainment once the COVID-19 nightmare is behind us, but our conclusion is that the resulting boost to expenditures will be limited," the economists said.

This conclusion - and likely outcome - is a key reason why, as Insider's Hillary Hoffower reported, a full economic recovery depends on the wealthiest Americans spending much more than they did over the last 12 months of the pandemic.